△ Small luxury △ Skinification △ Extreme cost performance △ Rebranding (K-Beauty) △ Beauty Tech (J-Beauty) △ Premium (C-Beauty).

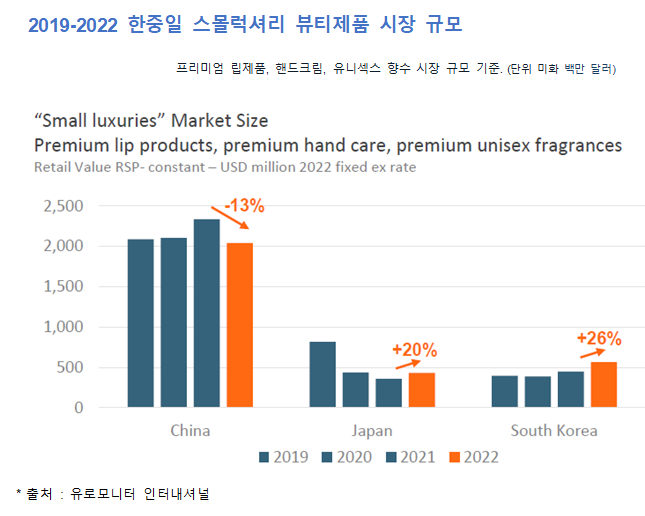

It is a beauty trend that will move the Asian market. In Korea, the small luxury market, which means 'small luxury', is strong. Compared to 2021, it grew by 26% last year. This year, small luxury has an impact on lipsticks, perfumes, and hand creams.

This was shown in the 'Asian Beauty Trend' announced by Euromonitor (Choi Seung-yong, Korea branch manager). This report analyzes the beauty and personal care market in 2022. It forecasts the consumption characteristics that will affect the Asian beauty market, including Korea.

Global beauty and personal care market to reach $530 billion in 2022

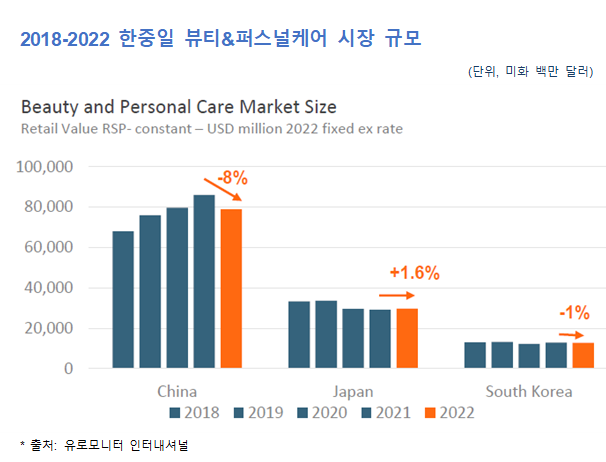

The size of the global beauty and personal care market in 2022 will be approximately $530 billion. Excluding inflation, this is a 0.4% drop compared to 2021.

The size of the Korean beauty and personal care market was estimated at 12.8 billion dollars (approximately 16.53 trillion won). 1% decrease from the previous year.

Euromonitor analyzed that the growth rate of the beauty market was low last year as China continued its home quarantine policy.

Hu Yang, Euromonitor Health & Beauty Asia Insights Manager, said, “Asian beauty brands have grown stronger by responding to various markets and consumers. Technology, flexible product composition, and diverse sales networks are the strengths of Asian Beauty.”

Lips, scalp, and gums are ‘skinified’

Asian beauty consumers are expanding the scope of skin care to lips, scalp, and gums. From anti-aging to hydration and nutrition, it is managed in a variety of ways.

Riding the trend of skinnification, consumer interest in derma products has increased. Derma cosmetics with scientific ingredients are growing in size.

According to the Euromonitor Beauty Survey, the global average of 19% said they looked at the ingredients first when buying cosmetics. Korean consumers accounted for 20% and Chinese consumers 25%, higher than the average.

Extreme cost performance and small luxury

High prices have affected beauty consumption patterns and brand product mix. As the number of consumers pursuing 'extreme cost performance' increased, PB received attention. In the mass beauty market, products with a unit price of less than $10 increased. Representative examples include PB products from Daiso in Korea, Lawson in Japan, and Miniso in China. These products were found to be mainly purchased by the Alpha generation, those born after 2010.

At the same time, the small luxury wind was strong. Lipstick, perfume, hand cream, etc. In particular, Korean consumers preferred small luxury. South Korea has the fastest growing small luxury market among Asian countries.

Euromonitor predicted that new beauty trends would captivate hybrid Asian consumers. Hybrid consumers are those who want to enjoy the benefits of both mass and premium products.

Global‧Technical‧Premium Dan Asia Beauty

K-beauty, J-beauty, and C-beauty are new. Beauty in Korea, Japan, and China, which led the growth of Asian beauty, has faced a new phase.

K-Beauty, a leader in the Asian beauty market, focuses on rebranding. It is a change from the packaging that reflects K-culture to a neutral atmosphere. K-Beauty is concentrating on entering the US, India, and European markets based on brand renewal.

J-Beauty has stepped up to strengthen beauty tech. Shiseido and Gao are positioning themselves as beauty tech brands. It is developing personalized beauty solutions using AI technology. J-Beauty has been leading the functional cosmetics market based on R&D research. It is a move to regain leadership in the Asian beauty market by using beauty tech as a new growth engine in the face of endemic.

C-beauty combined with premium. C-beauty, which has grown explosively over the past 2-3 years, has focused on premiumization. This is the stage of throwing away the cheap and popular image. While increasing R&D investment, focus on items with high growth potential, such as perfume.